Newsletter

Publié le 27/05/2024

Why is the Swiss rental property market increasingly tight ?

In this latest edition, we bring you key information on the housing situation in Switzerland, how to read the current real estate rental market and our tips on how to make the most of the situation.

-

DECLINE IN PROPERTY ADVERTISING

-

POPULATION GROWTH

-

VACANCY RATE

-

CONSTRUCTION OF NEW BUILDINGS

-

RENT INCREASES

-

WHAT KIND OF FUTURE ARE WE HEADING FOR?

-

HOW CAN WE MAKE THE MOST OF THE CURRENT SITUATION?

DECLINE IN PROPERTY ADVERTISING

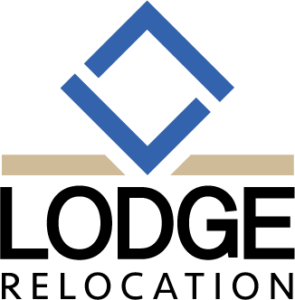

March 2023 property report, Wuest and Partner (a company that specialises in the production of data for the real estate sector) indicates that the number of properties advertised for rent in Switzerland has fallen by 31%. Martin Tschirren, Director of the Federal Housing Office, estimates that there will be a shortfall of “between 5,000 and 10,000 apartments a year over the next few years”.

In addition to the fall in the number of property advertisements, the significant reduction in their publication time, from 34 to 27 days, illustrates the increase in demand in the face of limited supply and highlights the intense competition for access to housing.

This lack of supply is likely to become entrenched in the medium term, due to a number of factors: demographic trends, rising immigration, changes in the structure of society (divorces), the stability of the Swiss job market, building restrictions, and the time it takes to implement property projects, etc.

POPULATION GROWTH

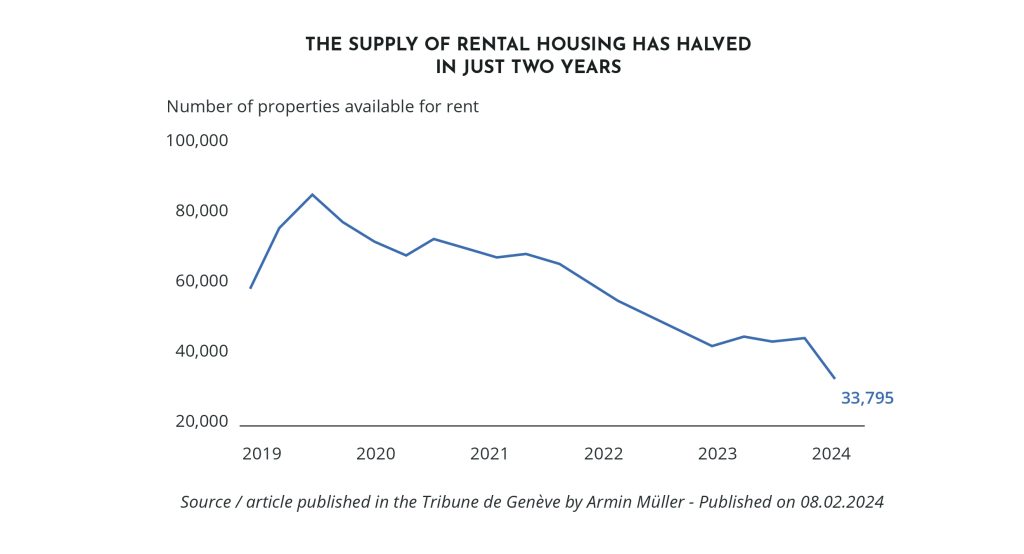

In the 3rd quarter of 2023, Switzerland’s permanent resident population stood at 8,931,306 (according to the Federal Statistical Office). Switzerland is on course to reach 9 million inhabitants by 2024. The recent increase in immigration (around 100,000 people arriving in 2023) has also played a role in this major demographic growth.

Due to the war in Ukraine and an economy that is faring better than in neighbouring countries, Switzerland’s appeal to expatriates and new arrivals has intensified competition in the rental market.

The increased need for housing is likely to continue, particularly in the major conurbations of Basel, Geneva, Lausanne, Neuchâtel, and Zurich.

VACANCY RATE

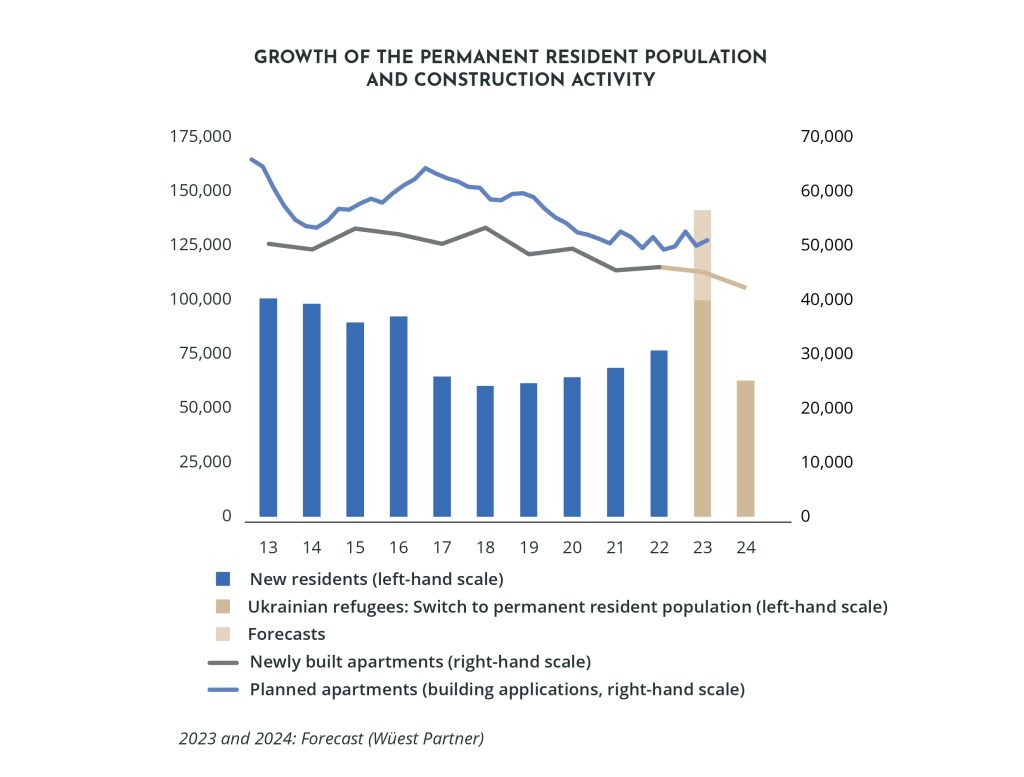

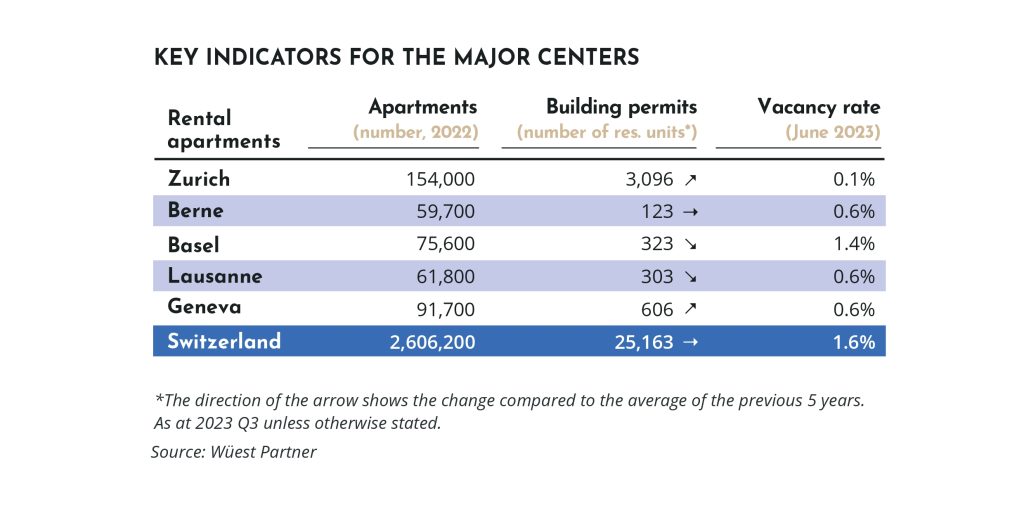

In Switzerland, the housing vacancy rate is historically low, particularly in urban areas. The further fall in this rate, as seen below, is an indicator of an increasingly tight market, since a vacancy rate below 1% means that virtually all rental properties on the market are occupied.

According to the Federal Statistical Office, this rate fell from a national average of 1.54% in June 2021 to 1.15% in June 2023. This trend is reflected in most of Switzerland’s cantons, with 3 and 4 room flats being the hardest hit by this fall.

CONSTRUCTION OF NEW BUILDINGS

In 2020, the arrival of COVID in Switzerland forced construction work to stop, resulting in delays of between 6 months and 1 year, or even cancellations. As a result of this crisis, other factors are affecting the construction industry, such as rising construction costs and labour shortages.

In addition, the new law on town and country planning, introduced with the intention of regulating urban development and preserving the environment, has unintentionally slowed the construction of new homes. As the legislation made the process more complex and costly, and the number of building plots and areas available dwindled, the entire new-build industry experienced a decline in activity. As a result, planning permission for apartments has fallen to its lowest level for 20 years.

RENT INCREASES

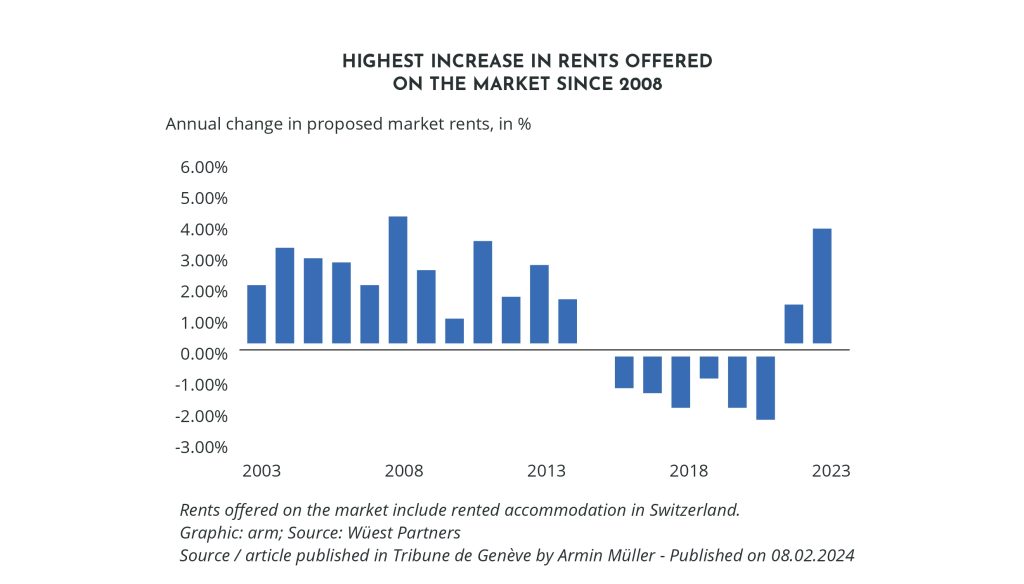

Due to the housing shortage, rising interest rates and the energy crisis, rental prices “will continue to rise sharply” over the next few years, according to Fredy Hasenmaile, Chief Economist at Raiffeisen bank in Switzerland.

On the one hand, rents for newly let properties have risen by an average of 4.7% over the past year.

On the other hand, existing rents, i.e. the prices of rental contracts that have been in force for some time, also rose by 2.2% in 2023 (the highest since 2008). The fact that the benchmark interest rate has twice been adjusted to 1.75% has enabled lessors to increase the rents on existing contracts.

This rise in rents has a direct impact on household budgets, which must take into account the fact that rents cannot exceed 25% of a gross annual salary (up to 30% in some cantons).

According to the Swiss Federal Statistical Office, rents are highest in the cantons of Zug, Zurich, Schwyz, Nidwalden, Geneva, Basel and Vaud.

WHAT KIND OF FUTURE ARE WE HEADING FOR?

Tackling the housing shortage in Switzerland is a complex challenge: the challenge is to meet not only the country’s economic requirements but also its social and environmental needs.

The federal government is currently examining measures to combat the housing shortage. Since the decline in construction is one of the main causes of this shortage, the emphasis is on increasing supply. These measures could include reforms to urban planning and construction policies to facilitate the emergence of new housing:

• by densification,

• by further construction on current buildings, thereby raising the height of buildings,

• by converting offices and hotels into housing.

HOW CAN WE MAKE THE MOST OF THE CURRENT SITUATION?

Although the market is tight, we observe certain key points to maximise a candidate’s chances of being selected by the property managing agents. Lodge Relocation ensures that our clients benefit from our network and expertise, but the candidates themselves also hold the cards.

- Drawing up a clear list of the customer’s essential criteria (geographical area, rent, number of square metres, parking, etc.) while remaining realistic about the possibilities offered by the market, is the starting point for any effective search.

- Responsiveness remains the most important factor in the home search process. Firstly, in putting together a complete file, then deciding whether or not to apply for a property.

- The Swiss law LDTR* relating to renovations and building extensions, is a very interesting way of giving future tenants access to a new property at an advantageous/moderate rent for a defined number of years. It should be remembered, however, that it is the final rent (the rent applied after the advantageous period) that is considered when assessing the applicant’s solvency. *The LDTR law obliges landlords/investors to maintain a defined percentage of low rents

in a building for a defined number of years. - Finally, it is essential that the conditions for accepting an application are respected: the rent cannot exceed 1/3 of the gross monthly salary. However, if an applicant with a high salary would like to apply for an apartment with a low rent it could be difficult to obtain. The property managing agents tend not to select this type of application; with a social objective in mind, priority will be given to families rather than single people or couples for flats with several bedrooms.